The Fair Labor Standards Act (FLSA) continues to evolve, with recent updates to overtime regulations significantly impacting businesses across the United States. As of June 2024, the Department of Labor has implemented crucial changes to FLSA rules, making it imperative for organizational leaders to stay informed and compliant. This webinar will provide a comprehensive overview of these updates, including the latest developments on salary thresholds and employee classifications.

Staying current with FLSA regulations is paramount for both compliance and business success. Failure to adhere to these new rules can result in severe financial penalties, legal complications, and damage to your organization's reputation. This course will equip you with the knowledge and strategies needed to navigate these changes effectively, ensuring your business remains compliant while optimizing its workforce management practices.

By the end of this webinar, participants will be able to:

• Interpret the latest FLSA exemption and overtime rules, including their impact on non-profit organizations

• Apply the updated Duties Test and Salary Level Test to accurately classify employees across various roles

• Differentiate between hourly, salary exempt, and salary non-exempt employee classifications

• Implement effective strategies for employee reclassification in light of the new regulations

• Understand and apply the revised rules for Highly Compensated Employees

• Conduct a comprehensive FLSA compliance review within their organization

• Develop best practices to ensure ongoing FLSA compliance and mitigate legal risks

• Analyze the potential financial implications of the new regulations on payroll and legal costs

Who Should Attend:

• Human Resource Managers & Directors

• HR Compliance Officers

• Employment Lawyers

• Business Owners and Executives

• Compliance Officers & Risk Managers

RELATED COURSES

How to Document Employee Performance Issues: From Hire to Fire or Retire

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

2024 The Fair Labor Standards Act: How to Properly Classify Employees as Exempt or Non-Exempt

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

Navigating Cannabis Regulations: Essential Guidelines for HR and Business Leaders (SSWS01)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

2025 Employee Terminations: A Comprehensive Guide for HR and Managers (SSCK01)

- Instructor: Cynthia Keaton

Effective Documentation Strategies: Ensuring Compliance and Mitigating Risks (SSMF01)

- Instructor: Margie Faulk, PHR, SHRM-CP

2025 Leave Laws- ADA/ FMLA & Workers Comp. (SSLS01)

- Instructor: Lauren M. Sobaski

Travel Pay: Navigating Year End and Preparing for 2025 (SSVL01)

- Instructor: Vicki Lambert, CPP

Ringing in the New Year Taxwise: Payroll Tax Changes for 2025 (SSVL02)

- Instructor: Vicki Lambert, CPP

I-9 Compliance: Navigating the New Landscape of Workforce Enforcement (SSLS02)

- Instructor: Lauren M. Sobaski

Mastering Form I-9 Compliance with Step-by-Step Guidance and Best Practices in 2025 (SSMF02)

- Instructor: Margie Faulk, PHR, SHRM-CP

EEO-1 Reporting: Prepare for the June 24, 2025 Deadline (SSWS02)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

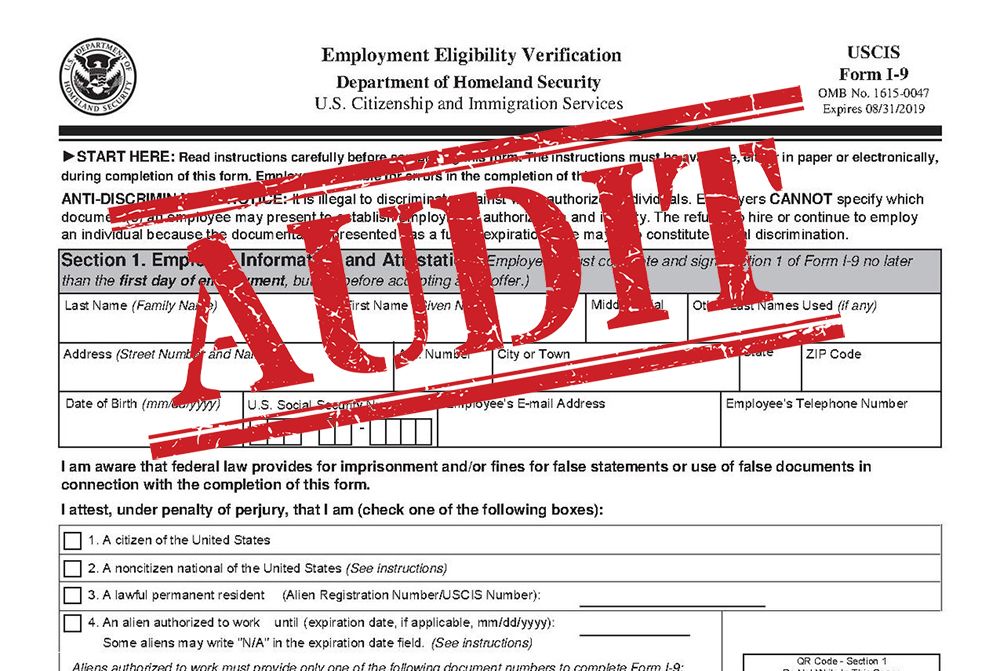

Employers Should Prepare for Immigration Raids in 2025: Increased I-9 Audits by ICE (SSMF03)

- Instructor: Margie Faulk, PHR, SHRM-CP

Payroll Tax Withholding in 2025: Stay Compliant and Avoid Liabilities (SSDC02)

- Instructor: Debbie Cash, CPP

Employee Working from Anywhere…Compliance Issues That Must Be Resolved (SSVL04)

- Instructor: Vicki Lambert, CPP

OBBB 2025: Payroll Deductions and Reporting Explained (SSDC03)

- Instructor: Debbie Cash, CPP

Succeeding as a One-Person HR Department (SSWS03)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Terminating Employees in 2025: A State-By-State Review (SSVL05)

- Instructor: Vicki Lambert, CPP

2025 Employer Update: Medicaid, Tax-Free Wages, and Staying Compliant (SSWS04)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Form 941 for 2025: What’s Next for 2025? (SSVL07)

- Instructor: Vicki Lambert, CPP

HR Investigations 101: The Basics for How to Conduct Workplace Investigations (SSNI01)

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

IRS Form W-4 Updates for 2025: Line-by-Line Preparation Guide (SSVL08)

- Instructor: Vicki Lambert, CPP

How to Properly Handle Employee Relations Issues in 2025 (SSNI02)

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

Payroll Deductions in 2025: What Can and Cannot Be Deducted from an Employee's Paycheck (SSVL09)

- Instructor: Vicki Lambert, CPP

The 2026 Employee Handbook Update: What Employers Must Know (SSMF04)

- Instructor: Margie Faulk, PHR, SHRM-CP

Best Practices For Multi-State Payroll Tax in 2025 (SSDC04)

- Instructor: Debbie Cash, CPP

Immigration Compliance and Workplace Visas: What Employers Need to Know (SSMF05)

- Instructor: Margie Faulk, PHR, SHRM-CP

Mandated Sick Pay Compliance: Navigating State Laws and Employer Obligations (SSWS05)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Preventing & Handling ICE Raids: Guidelines for Employers (SSMF06)

- Instructor: Margie Faulk, PHR, SHRM-CP

Managing Overlapping Leave Laws: What HR Needs To Know About ADA, FMLA & PWFA (SSNI03)

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

Preparing for Year End 2025 and Year Beginning 2026 (SSVL10)

- Instructor: Vicki Lambert, CPP

Workplace Compliance Specialist (WCS) Program Part - 1 (SSWS07)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Workplace Compliance Specialist (WCS) Program Part - 2 (SSWS08)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

2026 Active Shooter in the Workplace: How to Respond, Limit Liability and Long-term Consequences. (SSBM01)

- Instructor: Bo Mitchell, CEM, CPP, CHS-V

OSHA Recordkeeping & Reporting – 2026 Updates (SSJK01)

- Instructor: Joe Keenan, MBA, CSP