In today's workplace, HR and Employee Relations professionals often find themselves inundated with a myriad of employee complaints, ranging from harassment and hostile work environments to claims of unfair treatment and retaliation. However, many HR professionals lack the necessary training in conducting thorough and effective investigations. This webinar addresses this critical gap by providing essential knowledge and skills for handling employee complaints and conducting internal investigations with confidence and compliance.

Key Topics Covered:

• Identifying common types of internal investigations.

• Assessing the seriousness of employee complaints to determine the need for an investigation.

• Obtaining and documenting statements of complaint.

• Understanding legal obligations requiring internal investigations.

• Handling documentary and physical evidence effectively.

• Conducting witness interviews and establishing a chain of custody.

• Analyzing evidence to identify policy or legal violations.

• Documenting investigative findings in a clear and concise manner.

• Best practices for handling disciplinary action and terminations while avoiding legal pitfalls.

Learning Objectives:

By the end of this webinar, participants will:

• Recognize various types of internal investigations and their significance.

• Develop skills in evaluating employee complaints and determining the need for an investigation.

• Acquire techniques for collecting and documenting statements of complaint and evidence.

• Understand legal obligations and best practices for conducting thorough investigations.

• Gain proficiency in analyzing evidence and documenting investigative findings.

• Enhance their ability to handle disciplinary actions and terminations in a legally compliant manner.

Who Should Attend:

This webinar is essential for HR professionals, Employee Relations specialists, managers, supervisors, and anyone responsible for handling employee complaints and conducting internal investigations.

RELATED COURSES

How to Document Employee Performance Issues: From Hire to Fire or Retire

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

2024 The Fair Labor Standards Act: How to Properly Classify Employees as Exempt or Non-Exempt

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

Navigating Cannabis Regulations: Essential Guidelines for HR and Business Leaders (SSWS01)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

2025 Employee Terminations: A Comprehensive Guide for HR and Managers (SSCK01)

- Instructor: Cynthia Keaton

Effective Documentation Strategies: Ensuring Compliance and Mitigating Risks (SSMF01)

- Instructor: Margie Faulk, PHR, SHRM-CP

2025 Leave Laws- ADA/ FMLA & Workers Comp. (SSLS01)

- Instructor: Lauren M. Sobaski

Travel Pay: Navigating Year End and Preparing for 2025 (SSVL01)

- Instructor: Vicki Lambert, CPP

Ringing in the New Year Taxwise: Payroll Tax Changes for 2025 (SSVL02)

- Instructor: Vicki Lambert, CPP

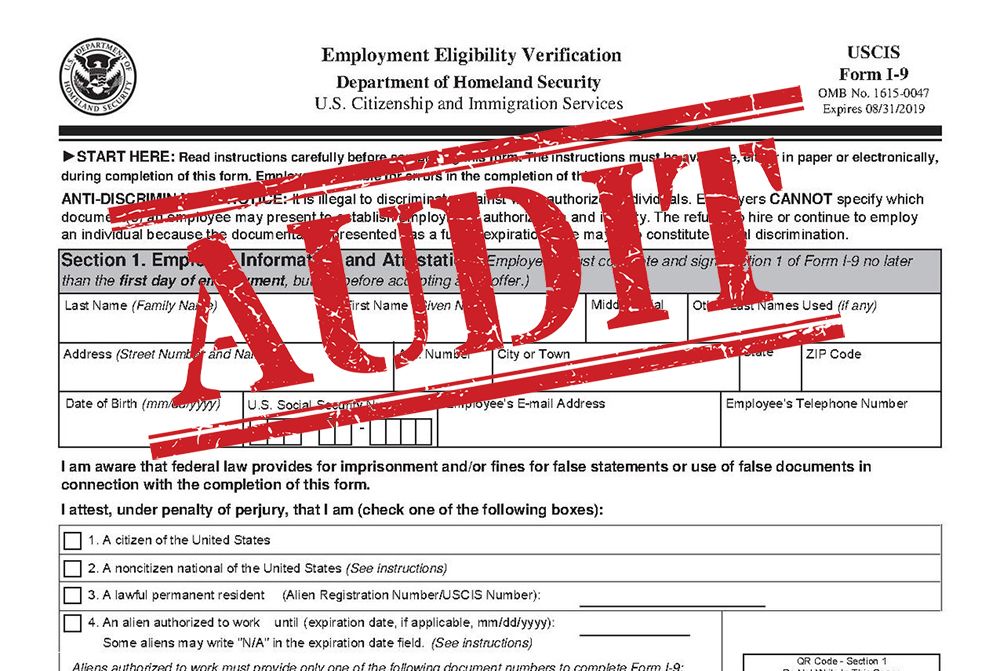

I-9 Compliance: Navigating the New Landscape of Workforce Enforcement (SSLS02)

- Instructor: Lauren M. Sobaski

Mastering Form I-9 Compliance with Step-by-Step Guidance and Best Practices in 2025 (SSMF02)

- Instructor: Margie Faulk, PHR, SHRM-CP

EEO-1 Reporting: Prepare for the June 24, 2025 Deadline (SSWS02)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Employers Should Prepare for Immigration Raids in 2025: Increased I-9 Audits by ICE (SSMF03)

- Instructor: Margie Faulk, PHR, SHRM-CP

Payroll Tax Withholding in 2025: Stay Compliant and Avoid Liabilities (SSDC02)

- Instructor: Debbie Cash, CPP

2025 Employee Working from Anywhere…Compliance Issues That Must Be Resolved (SSVL04)

- Instructor: Vicki Lambert, CPP

OBBB 2025: Payroll Deductions and Reporting Explained (SSDC03)

- Instructor: Debbie Cash, CPP

Succeeding as a One-Person HR Department (SSWS03)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Terminating Employees in 2025: A State-By-State Review (SSVL05)

- Instructor: Vicki Lambert, CPP

2025 Employer Update: Medicaid, Tax-Free Wages, and Staying Compliant (SSWS04)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Form 941 for 2025: What’s Next for 2025? (SSVL07)

- Instructor: Vicki Lambert, CPP

IRS Form W-4 Updates for 2025: Line-by-Line Preparation Guide (SSVL08)

- Instructor: Vicki Lambert, CPP

How to Properly Handle Employee Relations Issues in 2025 (SSNI02)

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

Payroll Deductions in 2025: What Can and Cannot Be Deducted from an Employee's Paycheck (SSVL09)

- Instructor: Vicki Lambert, CPP

The 2026 Employee Handbook Update: What Employers Must Know (SSMF04)

- Instructor: Margie Faulk, PHR, SHRM-CP

Best Practices For Multi-State Payroll Tax in 2025 (SSDC04)

- Instructor: Debbie Cash, CPP

Immigration Compliance and Workplace Visas: What Employers Need to Know (SSMF05)

- Instructor: Margie Faulk, PHR, SHRM-CP

Mandated Sick Pay Compliance: Navigating State Laws and Employer Obligations (SSWS05)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Preventing & Handling ICE Raids: Guidelines for Employers (SSMF06)

- Instructor: Margie Faulk, PHR, SHRM-CP

Managing Overlapping Leave Laws: What HR Needs To Know About ADA, FMLA & PWFA (SSNI03)

- Instructor: Natalie Ivey, MBA, SPHR, SHRM-SCP

Navigating FLSA Overtime Updates: Compliance Strategies for Leaders (SSWS06)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Preparing for Year End 2025 and Year Beginning 2026 (SSVL10)

- Instructor: Vicki Lambert, CPP

Workplace Compliance Specialist (WCS) Program Part - 1 (SSWS07)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP

Workplace Compliance Specialist (WCS) Program Part - 2 (SSWS08)

- Instructor: Wendy Sellers, MHR, MHA, SHRM-SCP